Mercator Partners

ESG Policy

Introduction

Motive/Belief/Objectives/Beneficiaries:

Mercator Partners’ (‘Mercator’) core investment focus is the impact of decarbonization and structural disruption across the asset heavy industries such as power production, transportation, manufacturing, and primary production. Decarbonization can be viewed as encompassing the key themes or sources of disruption; “the energy transition”, “efficiency & sustainability”, and “the circular economy”. Incumbents in the asset heavy sectors have been the largest contributors to environmental degradation and climate change, largely due to them avoiding pricing their external environmental and societal costs. This is rapidly changing as societal awareness around climate and the environment is increasing and the tolerance for polluting technologies and poor corporate behavior is being eroded. R&D across materials science, green technologies, electrification, and digitization drive innovation and competitive economics for alternative efficient and sustainable activities and business models. Over the next two decades new and nascent technologies and corporates will scale and succeed, while incumbents must pivot or lose market share. Mercator seeks to capitalize on this structural change via a long/short global low-net mandate offering investors exposure to a decarbonization focused, sustainable, and transparent investment process and portfolio. Scope: All activities in the Mercator Convergence Funds (known as the ‘Fund(s)’).

Scope:

All activities in the Mercator Convergence Funds (known as the ‘Fund(s)’).

Definitions

- Sustainable Investment(s): An investment that is partially or fully (based on revenue) – eligible or aligned – with the EU Taxonomy Regulation1 for sustainable activities according to its defined environmental objectives and evaluation criteria.

- Physical risk2: A direct negative impact on company’s financial value from acute and chronical climate change.

- Transition risk2: An in-direct negative impact on a company’s financial value from its negative contribution to sustainability factors and mediated via societal response through policy, regulations, technology, market forces, and reputational risk.

- Engagement: Any direct corporate or management interaction (email/phone/in person), or via third party (CDP, UNPRI), in which questions are raised about the company’s relevant non-financial climate related disclosures or lack thereof.

- Environmental characteristics: As it pertains to SFDR Article 86 disclosures the following characteristics will be promoted by the Fund.

- Long – Eligibility with the EU Taxonomy. For the purposes of the Funds, “eligibility” means the investment contributes to an environmental objective identified in Article 9 of the Taxonomy Regulation (Regulation (EU) 2020/852) (“Taxonomy Regulation”), which Mercator has assessed as being a sustainable investment for the purposes of Article 2(17) of the EU Sustainable Finance Disclosure Regulation (Regulation 2019/2088) (“SFDR”), but for the specific investment there is not enough data disclosure to evaluate if the investment meets all of the conditions under Article 3 of the Taxonomy Regulation to be designated as an “environmentally sustainable economic activity”. For the purposes of the Funds, “eligibility” also includes sustainable investments contributing to an environmental objective, but for which detailed technical screening criteria have not yet been adopted. The Product will take long positions in such assets.

- Long – Alignment with the EU Taxonomy. The Product will take long positions in investments that are aligned with the EU Taxonomy. For the purposes of this Product, “alignment” means investments that meet the criteria under Article 3 of the Taxonomy Regulation.

- Short – Transition Risk The Product aims to take short positions in investments that are identified as having elevated levels of transition risk. High levels of Scope 1, 2 and 3 emissions per unit of revenue are considered as a critical aspect for decarbonization and exposure to transition risk. In addition to Scope Emissions, other environmental KPIs and unsustainable business activities, indicating a high degree of transition risk will be considered in taking short positions. Investments will be evaluated on an absolute basis or comparisons to peer or industry averages/benchmarks.

Sustainable Investment Guidelines

Sustainable investment strategies/practices:

Mercator’s equity and primary research process lend themselves to a quantitative and science-based sustainability evaluation where an in-depth understanding of corporate data generation via Life Cycle Assessments (LCAs) is used. Since the Funds inception in April 2019 the portfolio themes and portfolio exposures have overlapped with the eligible economic activities outlined under the EU Taxonomy’s Environmental Objectives. Mercator’s firm view is that the EU Taxonomy will become the global “Gold Standard” for Sustainable Investment and drive enhanced climate related disclosures from both corporate and financial market participants.

The Funds therefore comply on a voluntary basis with the disclosures required for an SFDR Article-8 product making Sustainable Investments.

Sustainability standards for investee companies:

- EU Taxonomy Sustainable Investment

- Contribute to Environmental Objectives (Climate change mitigation, climate change adaptation, sustainable use/protection of water & marine resources, circular economy, waste prevention and recycling, pollution prevention and control, protection and restoration of biodiversity/ecosystems)

- Criteria I4 – Meet quantitative thresholds for sustainable activities

- Criteria II4 – Do no significant harm (DNSH) to other objectives

- Criteria III – Meet minimum safeguards (OECD Guidelines on Multinational Enterprises and the UN Guiding Principles on Business and Human Rights)

- SFDR Sustainable Investment

- Meet the promoted environmental characteristic as defined in Definitions 5.1, 5.2 2.

- Good Governance – all investments must adhere to good governance practices

- Do No Significant Harm – to other environmental or social objectives under the SFDR

- Positive contribution – investments must have a 20% minimum of revenues in products/services contributing to objective

- Given the long/short mandate and the environmental characteristic “Short Transition Risk” expressed in the short book, by definition the assets invested in the short book are not eligible for Taxonomy Regulation or SFDR sustainable investment evaluation.

Applicable Asset Classes: Global public equities

Sustainable Investment Insight Incorporation Procedures/Approaches

- The Funds seeks to position in companies impacted by structural disruption from decarbonization across the asset heavy/basic industries.

- Long exposure:

- Companies and business models leveraged to the opportunity created for technologies/processes/products/materials contributing substantially and positively to the EU Taxonomy environmental objectives and/or related sustainability factors,

- Contributing companies with a non- or negative contribution minority stake of legacy businesses with a clear path to eliminating/divesting that transition risk, and

- Select instances where a company’s activity falls outside of the Taxonomy, or there is an ambiguous interpretation relating to Taxonomy criteria or sustainability factors, but where a science based due diligence process can validate its overall beneficial contribution.

- Short exposure:

- Companies with a substantial negative contribution to EU Taxonomy environmental objectives and/or related sustainability factors, exposing them to significant transition risk.

- Long exposure:

- An assessment of the indicators for principal adverse impacts (“PAI”) is integrated into the Product’s due diligence process. Subject to data availability, we monitor the environmental and social impact of the activities of all investee companies against the mandatory and two selected additional PAI indicators identified in the SFDR Regulatory Technical Standards (‘RTS’). This is done on an ongoing basis using an internally developed monitoring system.

Engagement Procedures/Approaches

Engagement:

- In any direct corporate or management interaction (email/phone/in person) questions around a company’s non-financial climate related disclosures are asked with special focus on two areas:

- Scope 3 Emissions: These are the supply chain emissions and key areas/contributors are a) “Purchased goods and services” and b) “Use of sold products”. According to Final Draft RTS6 all EU investors need to start reporting these as of 1st Jan 2023. This means that EU investors holding non-EU companies in their portfolios will start pushing non-EU corporates for Scope 3 disclosures creating a global spillover effect from the EU Sustainable Finance Package7. Scope 3 emissions should be informed by a comprehensive Life Cycle Assessment (LCA) report verified by a certified independent third party.

- Carbon Offsets8: Many corporates have initiated programs in which they purchase carbon offsets to reduce their carbon emissions and claim net-zero. It is important to disclose additional information around these initiatives such as:

- What type of offsets are they buying (natural, technological)

- What was the price paid?

- Offset characteristics: clear science, net-carbon removal, verifiability, scalability, cost, permanence, & additionality

- As a signatory to (UNPRI, CDP) Mercator will also leverage these collaboration platforms for corporate engagement together with the broader investment community.

Reporting

- The Fund will follow the disclosures and reporting on a voluntary basis relevant for an Article-8 product “Light Green” under the SFDR6 regulation.

- Disclosures and reporting will be made available on Mercator’s website (https://mercatorpartners.com/) on an annual basis.

References:

- https://finance.ec.europa.eu/system/files/2020-03/200309-sustainable-finance-teg-final-report-taxonomy_en.pdf

- https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52019XC0620(01)

- Non-financial reporting frameworks

- CDP – Carbon Disclosure Project, https://www.cdp.net/en

- CDSB – Climate Disclosure Standards Board, https://www.cdsb.net/

- TCFD – Task Force on Climate-related Financial Disclosures, https://www.fsbtcfd. org/

- GRI – Global Reporting Initiative, https://www.globalreporting.org/

- IIRC – International Integrated Reporting Council, https://integratedreporting.org/

- SASB – Sustainability Accounting Standards Board, https://www.sasb.org/

- https://ec.europa.eu/info/files/sustainable-finance-teg-taxonomy-tools_en

- https://www.unpri.org/an-introduction-to-responsible-investment/an-introduction-toresponsible- investment-policy-structure-and-process/4917.article

- Final Report on draft Regulatory Technical Standards, April 2022

- Sustainable finance package – European Commission

- “Insights from analyzing a new round of carbon removal projects”, F. Chay, D. Cullenward, J. Hamman, and J. Freeman, 2021

Appendix

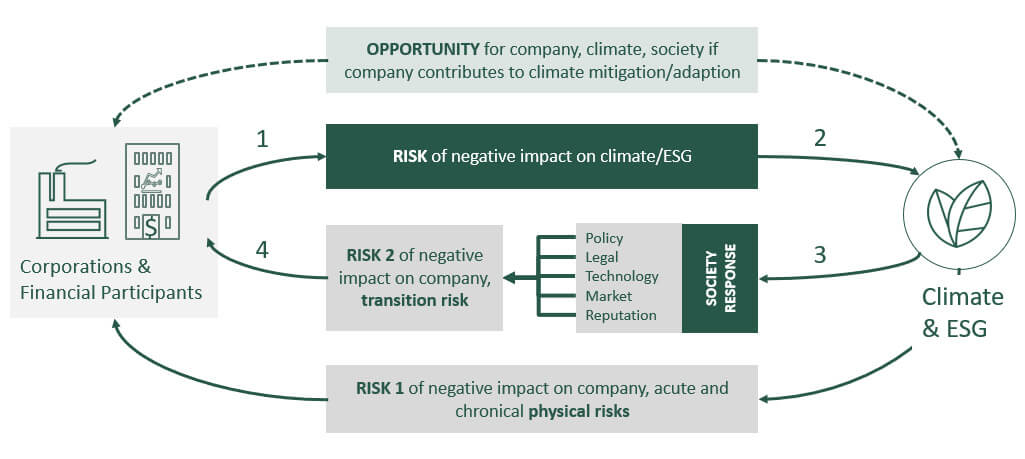

Illustration and explanation of physical, transition risk, and double materiality

Figure 1. From “Guidelines on non-financial reporting: Supplement on reporting climate-related information”, https://ec.europa.eu/finance/docs/policy/190618-climate-related-information-reportingguidelines_ en.pdf

Double Materiality for corporations requires information/disclosures to stakeholders on:

- Sustainability issues that directly influence enterprise value (financial materiality, inward impact).

- Business practices impacting on the economy, environment, and people (environmental and social materiality, outward impact) exposure to transition risk and additional financial materiality.

Risk 1 – Physical Risk:

Climate change imparts acute or chronic physical risks to a business model or assets, this information should be disclosed and the financial value at risk identified. Two illustrative examples are: 1) An insurance company’s exposure to property in increasingly flood prone regions, or 2) An agriculture business in a region increasingly exposed to severe droughts.

Risk 2 – Transition Risk: Exposes the full extent of a technology’s or an economic activity’s true inherent risk profile (financial materiality).

- A company’s or financial participant’s economic activity, represented by arrow 1, has a negative impact on climate/ESG and we call this Environmental and Social Materiality, indicated by arrow 2.

- Societal responses to climate change poor sustainability models are evolving and are becoming more effective via policy, regulation, alternative technologies, market forces, and reputational risk, indicated by arrow 3

- Transition Risk is the mapping and evaluation of an economic activity’s Environmental and Social Materiality vs. the Societal Responses, which in aggregate then translates into in-direct Financial Materiality for the company or Financial Market Participants, arrow 4.